Capital Markets Immersion

Last updated 5/2022

MP4 | Video: h264, 1280x720 | Audio: AAC, 44.1 KHz

Language: English | Size: 14.83 GB | Duration: 24h 24m

An essential, comprehensive guide to understanding the markets, players and products of the global capital markets.

What you'll learn

You'll be able to apply all the concepts of financial math, including NPV, IRR, PV, FV, to real business problems.

You'll learn how to describe the players, products, markets and applications of capital markets instruments.

You'll be able to interpret the meaning of yield curves and how financial markets and instruments drive pricing.

You'll be able to explain the full range of fixed income instruments, their issuers and investors, and the ways these instruments are structured.

You'll be able to detail equity markets products, players and market dynamics.

You'll be able to determine uses and applications of futures and options.

Requirements

Knowledge of the english language.

Basic math knowledge (a calculator is recommended for some of the lectures).

Description

The Capital Markets Immersion program provides a solid and deep introduction to the global capital markets. This course is designed to deliver a comprehensive, deep dive into the functions and roles played by modern financial institutions and their key lines of business. The program is intended for professionals (or those about to enter the business) with a foundational knowledge of the industry's basic products and services, and how each function.The program's framework consists of lectures covering 7 separate topics:1. The Capital Markets Road Map - Highlights the primary participants, issuers, investors, intermediaries in capital markets, what they trade there, and the applications to which market participants make use of the instruments and the roles they play.2. Fundamental Financial Math - Introduces you to a wide variety of calculations and related concepts that are used by financial market participants in a plethora of applications - calculating prices, rates of return, and yields for example.3. Yield Curve Dynamics - Covers a variety of issues relating to yield curves, their construction, and their use in a variety of analytical applications to assess risk and return.4. Fixed Income Securities - Introduces you to the market for fixed income securities, provides you with a lot of details on the characteristics of fixed income securities in general, as well as discuss specific characteristics of specific sectors of the fixed income market - insurers, investors, and a wide variety of concepts relating to the analysis and validation of those securities.5. Equity Products - Introduces equities by providing an overview of the types of products, including both direct and indirect products; and demonstrating types of shares and exchanges, investors, diversification and volatility.6. Futures & Options - Introduces derivatives in general, to demonstrate the common features of derivatives and how they differ from other sorts of financial instruments. Futures and options contracts' key characteristics will be identified, and contract features, pricing, applications, risk management, and hedging will be discussed.7. Interest Rate Swaps - A look at interest rate swaps in detail. First, swaps, in general, are introduced, then the structure of the most common type of interest rate swap - the fixed or floating interest rate swap - will be addressed. A variety of different structures, pricing and valuation, and applications - both risk management and speculative - will be discussed.In all, there are 142 total lectures (video clips) and over 24 hours of total view-able content. This program also includes supplemental PDFs as downloadable attachments that you can use to follow along with each lecture's instructor. More about this course and StarweaverThis course is led by a seasoned capital markets industry practitioner and executive with many years of hands-on, in-the-trenches financial markets sales, trading and analysis work. It has been designed, produced and delivered by Starweaver. Starweaver is one of the most highly regarded, well-established training providers in the world, providing training courses to many of the leading financial institutions and technology companies, including:Ahli United Bank; Mashreqbank; American Express; ANZ Bank; ATT; Banco Votorantim; Bank of America; Bank of America Global Markets; Bank of America Private Bank; Barclay Bank; BMO Financial Group; BMO Financial Services; BNP Paribas; Boeing; Cigna; Citibank; Cognizant; Commerzbank; Credit Lyonnais/Calyon; Electrosonic; Farm Credit Administration; Fifth Third Bank; GENPACT; GEP Software; GLG Group; Hartford; HCL; HCL; Helaba; HSBC; HSBC Corporate Bank; HSBC India; HSBC Private Bank; Legal & General; National Australia Bank; Nomura Securities; PNC Financial Services Group; Quintiles; RAK Bank; Regions Bank; Royal Bank of Canada; Royal Bank of Scotland; Santander Corporate Bank; Tata Consultancy Services; Union Bank; ValueMomentum; Wells Fargo; Wells Fargo India Solutions; Westpac Corporate Bank; Wipro; and, many others.Starweaver has and continues to deliver 1000s of live in-person and online education for organizational training programs for new hires and induction, as well as mid-career and senior-level immersion and leadership courses.If you are looking for live streaming education or want to understand what courses might be best for you in technology or business, just google:starweaver journey builder starweaver[dot]comHappy learning.

Overview

Section 1: Capital Markets Road Map

Lecture 1 Major Market Segments and Types of Instruments

Lecture 2 Economic Functions of Capital Markets

Lecture 3 Securities Markets and Important Market Participants

Lecture 4 Commercial Banking and Investment Banking

Lecture 5 Primary and Secondary Markets

Lecture 6 Primary Market Offerings

Lecture 7 Roles of Financial Intermediaries

Lecture 8 Comparing Securities to Derivatives

Lecture 9 Introduction to Fixed Income Securities

Lecture 10 Fixed Income Securities: Sources of Return and Types of Risk

Lecture 11 Government and Government Agency Securities

Lecture 12 Corporate Securities and Structured Securities

Lecture 13 Bond Pricing and Valuation

Lecture 14 Yield Curves, Credit Markets and the Business Cycle

Lecture 15 Yield Curves, Monetary Policy and the Real Economy

Lecture 16 Introduction to Equity Securities

Lecture 17 Investment Characteristics and Valuation of Equity Securities

Lecture 18 Valuation of Equities Using Earnings Multiples (P/E Ratios)

Lecture 19 Currency Markets and Factors Affecting Exchange Rates

Lecture 20 Types of Derivative Contracts and Economic Exposures

Lecture 21 The Real Meaning of "Derivatives" and Their Use in Managing Risk

Section 2: Fundamental Financial Math

Lecture 22 Interest Rates and Yields

Lecture 23 Interest Rates and Rates of Return

Lecture 24 Interest Rate Conventions and Time Value of Money Part 1

Lecture 25 Interest Rate Conventions and Time Value of Money Part 2

Lecture 26 Compound Interest

Lecture 27 Time Value of Money and Bond Pricing

Lecture 28 Pricing Zero Coupon Bonds

Lecture 29 Pricing Coupon Bonds

Lecture 30 Bond Pricing Versus Bond Valuation

Lecture 31 Pricing Discount Securities

Lecture 32 Discount Rates Versus Bond Equivalent Yield

Lecture 33 Bond Yields

Lecture 34 Yield to Maturity

Lecture 35 Yield to Maturity Versus Rate of Return

Lecture 36 Yield to Maturity as an Expression of Current Value

Section 3: Yield Curve Dynamics

Lecture 37 Introduction to Yield Curves

Lecture 38 Types of Yield Curves and Yield Curve Spreads

Lecture 39 Introduction to Duration

Lecture 40 Types of Duration

Lecture 41 Modified Duration

Lecture 42 Duration Illustration

Lecture 43 Duration of Callable Bonds

Lecture 44 Yield Curve Shapes and the Level of Interest Rates

Lecture 45 Yield Curve Theories

Lecture 46 Yield Curves and the Business Cycle

Lecture 47 Spot Rates and Spot Rate Curves

Lecture 48 Calculation of Spot Rates

Lecture 49 Bond Valuation and Rich/Cheap Analysis

Lecture 50 Treasury Strips and the Strip Rate Curve

Lecture 51 Forward Rates

Lecture 52 Calculating Forward Rates

Lecture 53 Forward Rate Applications

Lecture 54 Total Return Analysis

Lecture 55 Total Return Analysis Illustration

Section 4: Fixed Income Securities

Lecture 56 Introduction to Fixed Income Securities and Markets

Lecture 57 The Primary Market: Issuing Bonds to Borrow Funds

Lecture 58 Similarity of Bonds to Loans & Bond Valuation Issues

Lecture 59 Bond Contact Features

Lecture 60 Bond Coupons, Accrued Interest and Bond Pricing Conventions

Lecture 61 Day Count Conventions & Bond Retirement

Lecture 62 Types of Risk

Lecture 63 Sources of Return & Bond Yields

Lecture 64 Bond Yields, Yield to Maturity and Rate of Return

Lecture 65 Yield Curves

Lecture 66 Yield Curves & Government Securities

Lecture 67 Government Bonds & US Treasury Securities

Lecture 68 Corporate Fixed Income Securities

Lecture 69 Credit Risk of Corporate Securities & Trust Indentures

Lecture 70 Secured and Unsecured Bonds

Lecture 71 Convertible Securities

Lecture 72 Preferred Stocks & Introduction to Structured Securities

Lecture 73 Asset Securitization & Introduction to Mortgage Backed Securities

Lecture 74 Mortgage Backed Securities

Lecture 75 CMOs & Introduction to Asset Backed Securities

Lecture 76 Credit Card and Auto Loan Asset Backed Securities

Lecture 77 Collateralized Debt Obligations

Lecture 78 CDOs and Money Market Instruments

Lecture 79 Agency Securities & Regional/Local Government Debt Securities

Section 5: Equity Products

Lecture 80 Types of Products/Shares

Lecture 81 Buying Shares & Equities

Lecture 82 Tesco Example

Lecture 83 Types of Shares and Exchanges

Lecture 84 Depository Receipts

Lecture 85 Types of Investors, Diversification and Volatility

Lecture 86 Types of Indices Part I

Lecture 87 Types of Indices Part II

Lecture 88 Tracking Funds

Lecture 89 Exchange Traded Funds (ETF's)

Lecture 90 Introduction to Derivatives

Lecture 91 Forward Contracts

Lecture 92 Futures

Lecture 93 Equity Swaps

Lecture 94 Options

Lecture 95 Structured Products (Warrants, Certificates and Notes)

Section 6: Futures & Options

Lecture 96 Types of Derivative Contracts and Their Characteristics

Lecture 97 Derivatives Compared to Securities

Lecture 98 Derivatives Defined

Lecture 99 Futures Terminology and Contract Features

Lecture 100 Physical Delivery to Close a Futures Position

Lecture 101 Cash Settlement, OTC Derivatives

Lecture 102 Futures Clearinghouse and Third Party Contracts

Lecture 103 Futures Margins and Futures Contracts

Lecture 104 Clearinghouse and Futures Trades

Lecture 105 Comparing Futures Versus Underlying Positions

Lecture 106 Futures Positon Cash Flows and Hedging with Futures

Lecture 107 Futures Positions: Risk and the Cost Taking Position

Lecture 108 Cost of Carry/Carrying Charges

Lecture 109 Cost of Carry Pricing and The Forward Pricing Curve

Lecture 110 Option Fundamentals: Contract Features and Terminology

Lecture 111 Option Contract Example: Long Call Positions

Lecture 112 Option Pricing Basics

Lecture 113 Time Value, Instrinsic Value and Moniness

Lecture 114 Short Option Positions

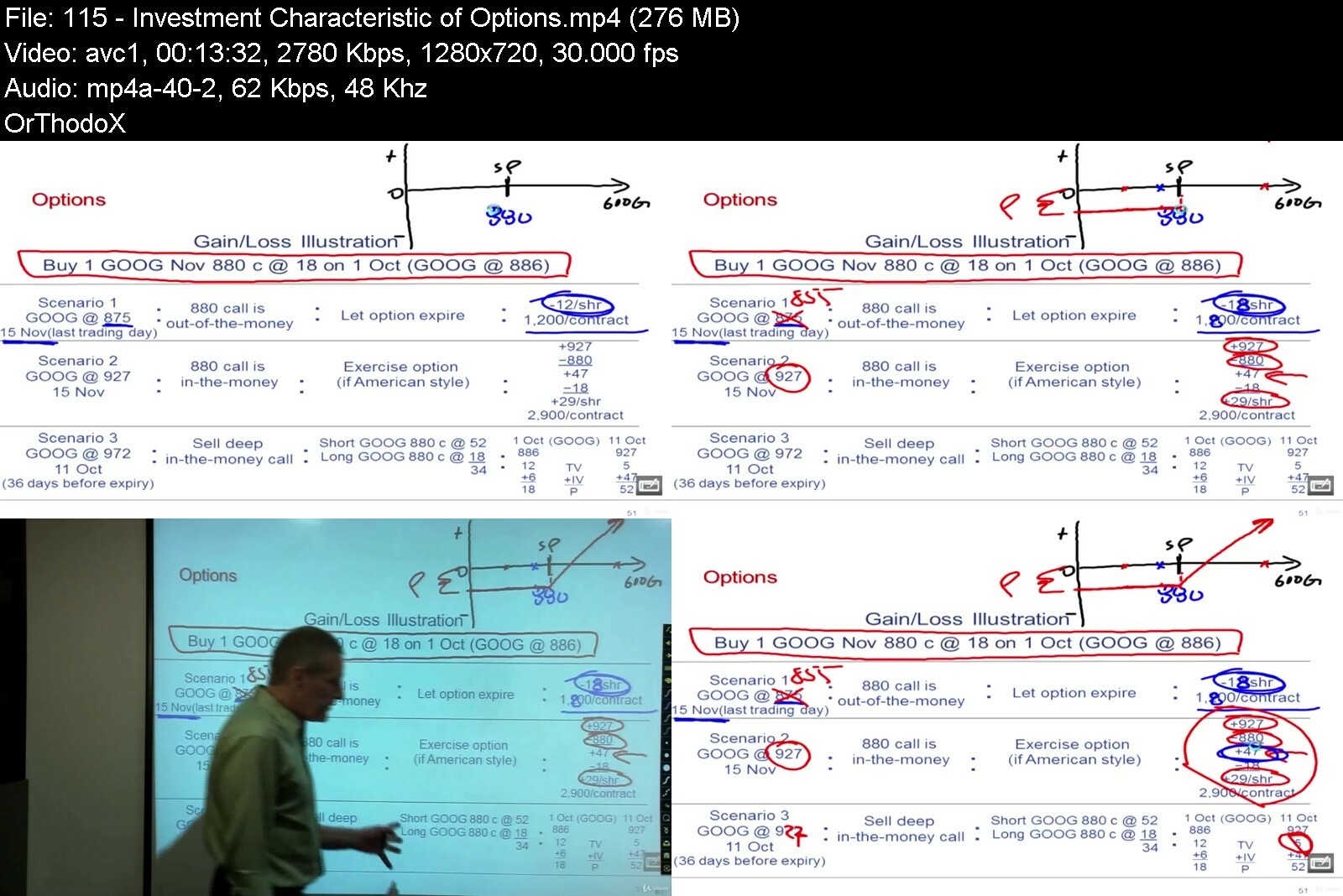

Lecture 115 Investment Characteristic of Options

Lecture 116 Overview of Long Put, Short Call and Short Put Positions

Lecture 117 Option Pricing and Sensitivities (Option "Greeks")

Lecture 118 Option Deltas

Lecture 119 Delta Hedging

Lecture 120 Delta Neutral Hedging Example

Lecture 121 Black-Scholes and Option Volatility (Vega)

Lecture 122 Implied Volatility and Volatility Trading

Section 7: Interest Rate Swaps

Lecture 123 Introduction of Swaps

Lecture 124 Interest Rate Swap Basics

Lecture 125 Interest Rate Swap Contract Features

Lecture 126 Fixed for Floating Interest Rate Swaps

Lecture 127 Periodic Settlement Payments on Interest Rate Swaps

Lecture 128 Hedging Cash Flow Uncertainty with Interest Rate Swaps

Lecture 129 Net Interest Cost of a Synthetic Fixed Coupon Bond

Lecture 130 OTC Clearinghouses

Lecture 131 Cleared Swaps Versus OTC Swaps Ex-Clearinghouse

Lecture 132 Functioning of OTC Clearinghouses

Lecture 133 Terminating a Swap Before Maturity

Lecture 134 Interest Rate Swap Pricing

Lecture 135 Pricing Fixed for Floating Interest Rate Swaps

Lecture 136 Valuing Swaps, Hedging Cash Flow Uncertainty

Lecture 137 Managing the Cash Flow Risk of Fixed and Floating Rate Assets

Lecture 138 Basis Swaps (Fixed Versus Floating Swaps)

Lecture 139 Capital Market Equivalents for the Fixed and Floating Rate Payers

Lecture 140 Value Hedging, Asset Swaps

Lecture 141 Variations in the Structure of Interest Rate Swaps

Lecture 142 Structuring and Pricing Basis Swaps

Section 8: Quizzes and Tests

Lecture 143 Your quizzes will appear here

Section 9: Closing Remarks

Lecture 144 Take-aways

Analysts and associates in commercial, corporate and investment banking.,Relationship managers (0-5 years) in commercial, corporate and investment banking.

Homepage

https://anonymz.com/?https://www.udemy.com/course/capital-market-immersion/

https://rapidgator.net/file/e46b40290d2d400372a32599b26152b1/Capital_Markets_Immersion.part1.rar https://rapidgator.net/file/3fb17b1415f35b60bc6488fe296c6ef6/Capital_Markets_Immersion.part2.rar https://rapidgator.net/file/fd9909db31a7185d350aaa7be25f3224/Capital_Markets_Immersion.part3.rar

https://k2s.cc/file/222494a487a93/Capital_Markets_Immersion.part1.rar https://k2s.cc/file/23b57cba7217d/Capital_Markets_Immersion.part2.rar https://k2s.cc/file/aa6383541eaab/Capital_Markets_Immersion.part3.rar

https://nitroflare.com/view/7CE493D6CEA068A/Capital_Markets_Immersion.part1.rar https://nitroflare.com/view/4A52050BEE8911D/Capital_Markets_Immersion.part2.rar https://nitroflare.com/view/F3D2A936D70C5DD/Capital_Markets_Immersion.part3.rar