Us Income Taxes - Income Tax Preparation Simplified For You

Last updated 1/2015

MP4 | Video: h264, 1280x720 | Audio: AAC, 44.1 KHz

Language: English | Size: 827.03 MB | Duration: 2h 36m

The A - Z of self-preparing and e-filing your basic income taxes by 04/15. Income tax preparation made easy for you.

What you'll learn

Understand basic federal income tax laws and how it applies to your own your own personal or household situation

Prepare and file your own basic federal and state income tax return

E-file your federal and state income tax return safely and securely for FREE.

Be in control of your income tax liability and refunds

Plan for your own personal income taxes in the future.

Discover, learn and apply the federal credits and deductions that are available to you as a taxpayer and your dependents

Gain and extend your knowledge of basic income taxes as a tool for your personal financial planning.

Save an average of $200/year by preparing and filing your own return.

Requirements

Ability to add, subtract, divide & multiply

Analytical skills

Patience in learning something new.

Access to a copy of your prior year's tax return for comparison purposes is preferred but not required.

Description

Student Course Feedback: "Dr. Jacinto, you were a great instructor. Your lectures were clear, precise and showed real "teacher" abilities. You enunciate so well and very easy to understand and follow. Your organization was noteworthy and covered the material well. I thoroughly enjoyed the entire course. In fact, I've listened to your lectures twice." 2015 Tax Season Ends. A season of SAVINGS begin! Enjoy this course for $9 ($39 regular price) while it is being updated for next year's (2016) tax season. See you inside! Income Tax Basic Training has one simple objective - and that is for you to be able to prepare & file your OWN federal & state income tax return by 04/15 by empowering you with the tools you need to understand & learn how US income tax system works. The course is delivered in simple, no-nonsense and straightforward terms to take the intimidation factor away from dealing with "taxes" and promote an engaging learning environment. All the materials you need to successfully complete the course are built-in. It's loaded with supplemental resources and quizzes to reinforce learning. The course walks you through how to prepare a basic 1040 from the beginning to the end. At the end of the course, you will understand how to calculate for your gross income subject to tax, adjusted gross income, the correct type of deduction to take: standard vs. itemized, the number of exemptions to claim, the credits that you may qualify for, your taxable income, tax liability, tax refund or tax due. Save yourself an average of $200/year by filing your own federal & state income tax return every year. A research conducted by the National Society of Accountants showed that the average of professional tax preparation is $152 for a simple 1040 and $261 for a 1040 with Schedule A. More importantly, be in control of your own taxes by knowing why you pay what you do and learning and understanding how taxes work and affect you. Your instructor promotes and encourages a lively class through the discussion forum. Expect her to respond to you within 24 hours or less. Before you sign up, please refer to the target audience for this course to see that it is the right one for you.

Overview

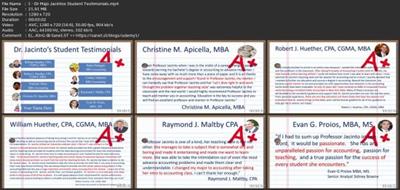

Lecture 1 Dr. Majo Jacinto's Student Testimonials

Section 1: Filing Basics

Lecture 2 Am I required to file a tax return?

Lecture 3 Which Form should I use?

Lecture 4 What is my filing status?

Section 2: Exemptions

Lecture 5 What are personal exemptions?

Lecture 6 What are dependency exemptions?

Section 3: Income items and related calculations

Lecture 7 How do I calculate the taxable income & liability?

Lecture 8 What income items are taxable and nontaxable?

Lecture 9 Salaries, Dividends, Interest & common sources of income

Lecture 10 Business Income

Lecture 11 Capital Gains and Losses

Lecture 12 Retirement Income

Lecture 13 Schedule E - Rental Income

Lecture 14 Is unemployment compensation taxable?

Lecture 15 Do I have to pay taxes on my social security income?

Lecture 16 I just won the lotto! Do I have to pay taxes?

Section 4: Adjustments to Income / Adjusted Gross Income

Lecture 17 Do I receive a tax break for paying alimony?

Section 5: Types of Deductions

Lecture 18 Do I qualify for standard deduction?

Lecture 19 What expenses can I itemize?

Section 6: My Tax & Credits

Lecture 20 What is my tax liability?

Lecture 21 Can I receive credit for child care expenses?

Lecture 22 Wow! My Udemy online courses may quality towards education credits.

Lecture 23 Can I receive $1,000 per qualifying child for child tax credit?

Lecture 24 More Credits?

Section 7: Other Taxes

Lecture 25 Other Taxes

Section 8: Payments and Refundable Credits

Lecture 26 Payments

Lecture 27 Earned Income Credit

Section 9: Bottom Line

Lecture 28 Refund or Tax Due

Lecture 29 State Income Tax & E-file for FREE

Section 10: Wrap Up

Lecture 30 Tax Software Sample Tax Return Walk-through

Lecture 31 Conclusion

Designed for low and moderate income taxpayers to learn & equip them with the training they need to file their own income tax return each year.,Tax filers with adjusted gross income of $60,000 or less that filed using forms 1040-EZ, 1040A or 1040 with Schedule A in 2013.,Taxpayers with combined gross income of under $100,000,First time filers,College students who worked part time during the year.,Accounting college students who need to take Federal Income Tax for Individuals - this training will supplement that class.,Individuals who pay income taxes every year but DO NOT understand why.,Individuals who are afraid of taxes.,Individuals who want to obtain basic income tax training to help others through volunteer tax work for the needy (VITA).,This course is only designed for US taxpayers.

download скачать link

rapidgator.net:

https://rapidgator.net/file/7e5952e08eea14aa77e4f018614d2169/yayfc.Us.Income.Taxes..Income.Tax.Preparation.Simplified.For.You.rar.html

uploadgig.com:

https://uploadgig.com/file/download скачать/CaAc97086cb9c0d3/yayfc.Us.Income.Taxes..Income.Tax.Preparation.Simplified.For.You.rar

nitroflare.com:

https://nitroflare.com/view/923F59B24730DC6/yayfc.Us.Income.Taxes..Income.Tax.Preparation.Simplified.For.You.rar

1dl.net:

https://1dl.net/4oqm2iz64s8z/yayfc.Us.Income.Taxes..Income.Tax.Preparation.Simplified.For.You.rar.html