Advanced Financial Modeling Course By Preparationinfo!

Published 8/2022

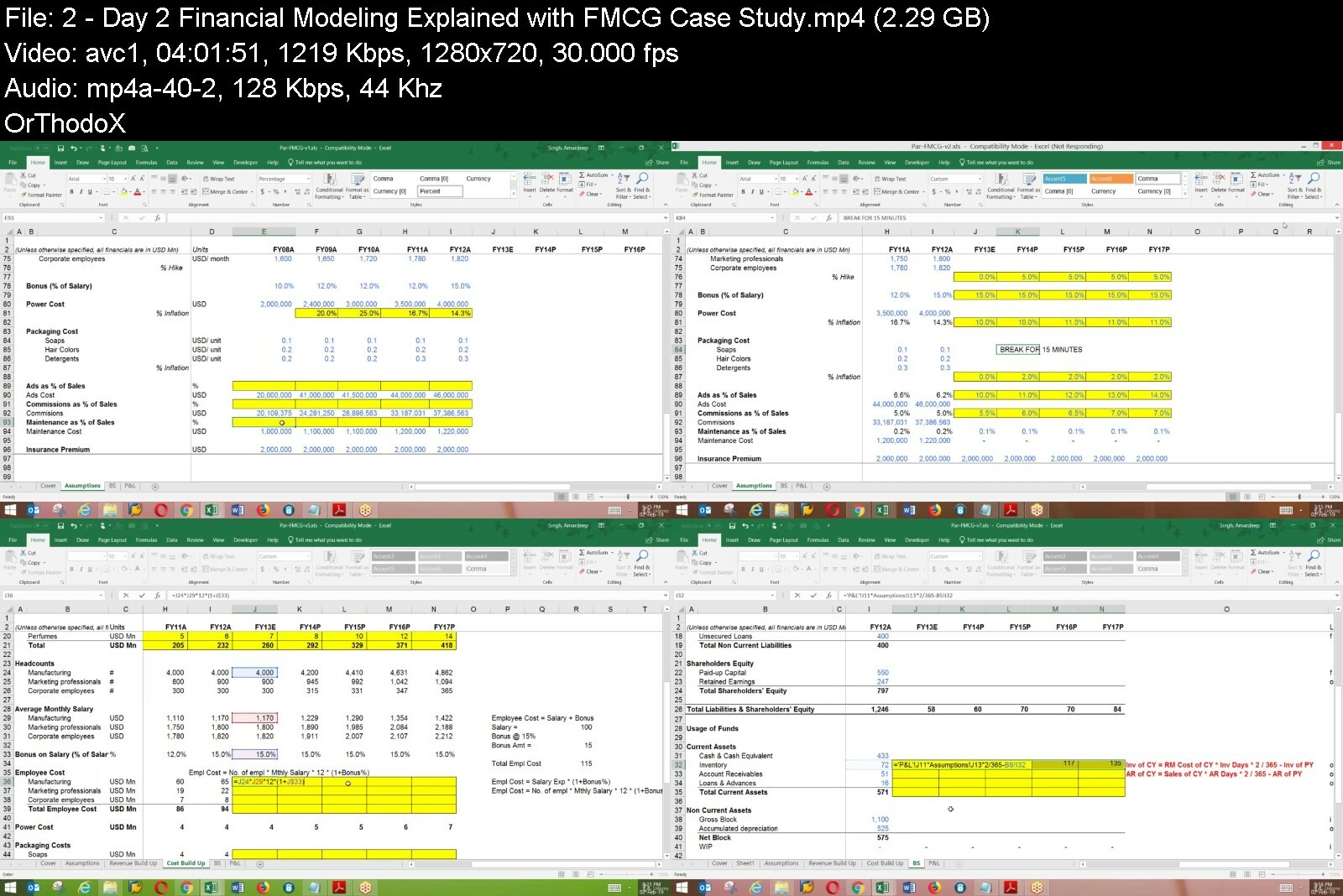

MP4 | Video: h264, 1280x720 | Audio: AAC, 44.1 KHz

Language: English | Size: 16.05 GB | Duration: 32h 46m

Become a Certified Financial Modeler. Get Trained by Industry Experts! 32 Hours of On-demand Course!

What you'll learn

Improved and in-Depth Understanding of a Business

Periodic Review of Performance

Decide the Fund Requirement & Strategy

Business Valuation

Risk Minimization

Financial Models Generate Quick Outputs

Much Accurate Financial Budgets and Forecasts

Helps in Business Growth

Requirements

This course doesn't require any specific pre-requisites. Participants with Interest towards Financial Modeling can join this course.

Description

Financial Modeling jobs can include positions like financial model analyst, data analyst, and financial analyst. When applying for jobs it can be crucial to include specific skills on a resume besides education and experience history. Learning what skills, you might include and how to showcase them on a resume can help you create one that recruiters and hiring managers notice. In this email, we discuss 11 of the best financial Modeling skills you can include on your resume and provide examples for each.After completing this course, you can some features in your resume:Accounting- "Exhibited strong knowledge of accounting principles when analyzing financial documents for clients."Spreadsheet management- "Created financial models in Excel using advanced tools like macros and lookup features."Forecasting-"Created models for forecasting asset management like loans, payments, and interest."Auditing-"Performed model audits on all models including technical assumptions and accurate calculations."Modeling types- "Built and maintained three-statement models to support investments and capital structuring."1. Three-statement model2. Discounted cash flow model3. Consolidation model4. Leveraged buyout modelProblem-solving-"Applied problem-solving skills to analyze data and deliver investment and merger solutions."Sensitivity analysis-"Created sensitivity analysis models to determine the effects of share prices on valuation."Data analysis-"Performed return on investment data analysis using the three-model analysis method to increase ROI by 10%."Industry-specific knowledge-" Assisted manufacturing and fabrication clients with financial Modeling and market research."Presentation-" Presented statistical analysis findings for investment opportunities to senior leadership using graphic tools and slide decks."Technology- "Used big data analytical tools and visualization programs to organize and present models in a clear way."Financial modeling is the process by which a firm constructs a financial representation of some, or all, aspects of the firm or given_security. The model is usually characterized by performing calculations and making recommendations based on that information. The model may also summarize particular events for the end user such as investment management returns or the Sortino ratio, or it may help estimate market direction, such as the Fed model.The outcome of training:Learn why Financial Models get failed and how to audit and rectify the errorsImprovement in building Financial models using VBA and macros/ExcelUnderstand the complete model with VBA codesLearn best practices in the world to build a robust financial modelComplete understanding of how other companies make use of Financial Models using real-life case studiesAfter this training, you will be able to Structure, Design & Build various financial problems and translate them into ExcelAfter this, you will be able to Understand valuation techniques through DCFCost of Capital (WACC)Terminal ValueFree_Cash_Flow to the firm and Equity HoldersIn the training, you will get a chance to discuss Financial Models from different industries and different companies.Module Wise Topics: Learn the Advanced Financial Modeling using Excel:Module 1:Overview of Fully Integrated ModelModel Design and StructureHistorical Financial Statement ModelingCalculating growth driversBuilding assumptions and forecastingBuilding the Asset and depreciationModule 2:Building Debt & Interest scheduleBuilding Cash_flow statementBuilding interest on excess_cash and cash_revolverBuilding ratios for analysisUpdating integrated model for valuation analysisModule 3:Introduction and context in Advanced functions for modelingCase: Selecting the relevant revenueCase: Portfolio analysisCase: Creating flexible models for scenarios.Case: Flexible model generation.Formula AuditingExcel Audit shortcutsFormula Auditing: Road ModelEvaluate FormulaAdvanced Charting techniqueTracking the progress of the construction of the commercial property: Radar ChartsSummary of Valuation /Creating Football_Charts/Stacked bar chartsModule 4:Introduction to Macros & Advanced Application Building in ExcelDesigning the application to gather user dataUnderstanding VBA and debuggingUnderstanding the relevant language constructsExample: Write your First MacroErrors in VBAStep into VBAWriting VBA codesAdvanced Financial ApplicationsBreaking circular loopsMonte Carlo simulation

Overview

Section 1: Complete Financial Modeling with Excel

Lecture 1 Introduction Day 1 - Essentials of Excel Skills in Building a Financial Model

Lecture 2 Day 2 - Financial Modeling Explained with FMCG Case Study

Lecture 3 Day 3 - Financial Modeling Explained with FMCG Case Study

Lecture 4 Day 4 - Financial Modeling Explained with FMCG Case Study

Lecture 5 Day 5: Introduction and context in Advanced functions for modeling

Lecture 6 Day 6: Formula Auditing and Advanced Charting Techniques

Lecture 7 Day 7: Macros and Advanced Application Building and Designing in Excel

Lecture 8 Day 8: Understanding VBA and Debugging and Advanced Financial Applications

MBA, Finance and Accounts Manager, СЕО (Поисковая оптимизация SEO, Sales Manager, Heads of Departments

https://anonymz.com/?https://www.udemy.com/course/advanced-financial-modeling-course-by-preparationinfo/

download скачать from RapidGator

https://rapidgator.net/file/6d8d14eb69d6cd702aa1f292cac2eced/Advanced_Financial_Modeling_Course_by_PreparationInfo.part01.rar https://rapidgator.net/file/01f9caa2b90ab21135258672276c4de7/Advanced_Financial_Modeling_Course_by_PreparationInfo.part02.rar https://rapidgator.net/file/88b1e20e392082d6054a5e0fc395391d/Advanced_Financial_Modeling_Course_by_PreparationInfo.part03.rar https://rapidgator.net/file/c0acfd32d0e86368e5866b002906187b/Advanced_Financial_Modeling_Course_by_PreparationInfo.part04.rar https://rapidgator.net/file/97cc9671d4cc2753ff15f84a09bbe34b/Advanced_Financial_Modeling_Course_by_PreparationInfo.part05.rar https://rapidgator.net/file/a2a62c40949ceb635d330ef637ce87e0/Advanced_Financial_Modeling_Course_by_PreparationInfo.part06.rar https://rapidgator.net/file/b6fe6b98828f6ac85ba311b2a5b25ee7/Advanced_Financial_Modeling_Course_by_PreparationInfo.part07.rar https://rapidgator.net/file/f7f8c59273f545bcb8eb3aeabd9c5850/Advanced_Financial_Modeling_Course_by_PreparationInfo.part08.rar https://rapidgator.net/file/4e0af6936cb16ade04b9246a28053afd/Advanced_Financial_Modeling_Course_by_PreparationInfo.part09.rar

download скачать from DDownload

https://ddownload.com/x4ino847kiue/Advanced_Financial_Modeling_Course_by_PreparationInfo.part01.rar https://ddownload.com/4reumotesz2k/Advanced_Financial_Modeling_Course_by_PreparationInfo.part02.rar https://ddownload.com/zn0ltxdudwe5/Advanced_Financial_Modeling_Course_by_PreparationInfo.part03.rar https://ddownload.com/n44yi9dn1v59/Advanced_Financial_Modeling_Course_by_PreparationInfo.part04.rar https://ddownload.com/1xk70u3w3e32/Advanced_Financial_Modeling_Course_by_PreparationInfo.part05.rar https://ddownload.com/edw3n6hq1qfo/Advanced_Financial_Modeling_Course_by_PreparationInfo.part06.rar https://ddownload.com/b2ny9cc3rzqx/Advanced_Financial_Modeling_Course_by_PreparationInfo.part07.rar https://ddownload.com/uq1su7mq3iwz/Advanced_Financial_Modeling_Course_by_PreparationInfo.part08.rar https://ddownload.com/pdz4z492xnfp/Advanced_Financial_Modeling_Course_by_PreparationInfo.part09.rar

Archive Password: "English name of the Old Continent" [First Letter Capital]